Why Investing in Tel Aviv Airbnb is Beneficial

Airbnb Market Analysis in Israel’s Top Cities: Where Profit Meets Culture

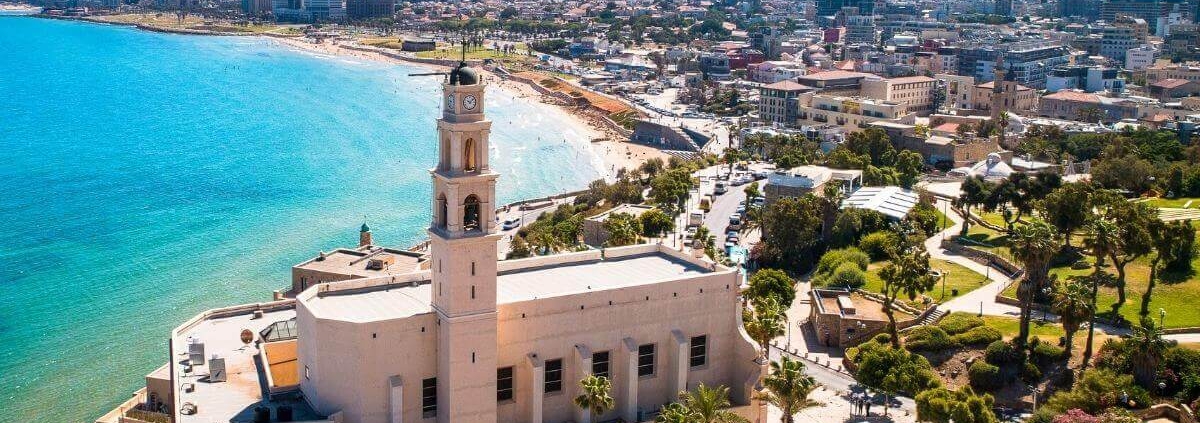

Tel Aviv, often dubbed the ‘Mediterranean’s Manhattan’, offers a blend of modern urbanism, rich history, and golden beaches. But have you ever pondered its thriving Airbnb market? Here’s the lowdown on why jumping onto the Tel Aviv Airbnb investment bandwagon might just be your best move yet.

Understanding Tel Aviv’s Booming Tourism

A Destination Like No Other

Tel Aviv boasts a unique fusion of historic landmarks, such as Jaffa, alongside skyscraping urban jungles and lively boulevards. These distinct features cater to a broad spectrum of tourists, ranging from history buffs to modern-day nomads. This creates a steady stream of tourists year-round, providing a robust foundation for the Airbnb market.

Year-round Tourism: Beyond Seasons

While some destinations experience a lull during off-peak seasons, Tel Aviv’s Mediterranean climate, which offers warm summers and mild winters, ensures a consistent influx of visitors. This translates to a potential year-round income for Airbnb hosts.

Economic Factors: Why It Makes Sense

Analyzing Tel Aviv Airbnb Metrics

Tel Aviv boasts a robust figure of 8,090 active rentals on Airbnb. This substantial number emphasizes the city’s appeal as a destination and the increasing preference among travelers to opt for personalized and authentic lodging experiences over traditional hotels.

With an Average Daily Rate of $193, Tel Aviv’s Airbnb accommodations manage to command a premium price. This rate, which is higher than many global cities, reflects the city’s unique offerings, from its rich cultural experiences and bustling tech scene to its scenic Mediterranean beaches.

The Occupancy Rate of 63% suggests that almost two-thirds of Tel Aviv’s Airbnb accommodations are occupied throughout the year. This is a respectable figure, especially when considering the vast number of listings available. The spike in occupancy to 74% in July showcases the seasonal appeal of Tel Aviv, likely due to summer vacations and popular events or festivals during this period.

An average revenue of $2,193 is a testament to the profitability of Airbnb investments in Tel Aviv. Combining this figure with the ADR and occupancy rate reveals that hosts in the city can expect a steady stream of income, making the market attractive for both existing and potential investors.

The data from AirDNA suggests that travelers to Tel Aviv value privacy and space, as 87% of the bookings are for entire homes. These are often preferred by families, groups, or even business travelers looking for a home-like environment.

Furthermore, one-bedroom apartments constitute 45% of the listings. This indicates a significant demand from solo travelers, couples, or business professionals who desire both space and affordability.

Tel Aviv’s Airbnb market is characterized by strong demand, respectable revenue figures, and a diverse array of accommodation types catering to various traveler needs. The metrics paint a picture of a vibrant and dynamic market where hosts can reap significant benefits if they strategically price and market their properties, especially considering the seasonal fluctuations. As travelers worldwide increasingly seek localized experiences, Tel Aviv’s unique blend of tradition and modernity positions it as a top choice, a fact clearly reflected in its Airbnb metrics.

Strong Return on Investment: Bolstered by Robust Data

Israel’s real estate landscape, despite its unique challenges, has shown remarkable resilience and growth. Between 2006 to 2017, Israel witnessed an extraordinary surge in house prices, rising by 118% (or 82% after adjusting for inflation). This translates to an average annual increase of nearly 9.1%.

Therefore, using Tel Aviv as a microcosm of this national trend, a property purchased for $500,000 in the city could potentially appreciate by approximately $45,500 in value every year, purely based on this market trajectory.

Between 2015 and 2021, the number of Airbnb listings in Tel Aviv grew by an estimated 10-15% annually. This robust growth trajectory underlines the increasing appeal of the platform in the city.

With an ADR of $193 and an average occupancy rate of 63% provided earlier, an average Airbnb listing in Tel Aviv can anticipate generating around $44,000 annually before accounting for operational expenses.

An investor purchasing a property in Tel Aviv for $500,000 and simultaneously tapping into the Airbnb market can expect a twofold financial windfall. Firstly, the house price appreciation could lead to a potential increase of around $45,500 in the property’s value annually. Secondly, by listing the property on Airbnb, there’s a prospective annual rental income of approximately $44,000.

Tel Aviv’s Approach to Short-Term Rentals: Embracing a Global Trend

Tel Aviv, an iconic tourist hotspot, has astutely adapted to the evolving tastes of global travelers, with a notable surge in listings on platforms like Airbnb. This expansion showcases the city’s adaptability and openness to new economic avenues.

A Thriving Market with Global Appeal

About 8,000 dwellings in Tel Aviv are poised to welcome travelers via Airbnb.

The impressive rise of Airbnb listings is a testament to the city’s appeal and the locals’ entrepreneurial spirit.

A Fresh Alternative to Traditional Lodging

Airbnb offers a unique, home-like experience, presenting travelers with options beyond conventional hotels.

While hotels have voiced concerns about competition, platforms like Airbnb enrich the range of accommodation choices for visitors.

Navigating Regulatory Waters

Tel Aviv City Hall, being proactive, has considered a proposal around limiting short-term rentals to 90 days annually, aiming for a balanced ecosystem for both residents and visitors.

Previous Regulatory Engagements

Past discussions on potentially increasing the municipal tax (arnona) for short-term rentals emphasize the city’s commitment to ensuring fairness across all housing segments.

City’s Vision for A Harmonious Blend

The city values its global appeal and is keen on striking the right balance. While tourism is vital, ensuring the essence of local neighborhoods remains undisturbed is equally paramount.

Embracing platforms like Airbnb reflects Tel Aviv’s forward-thinking attitude. It underscores the city’s efforts to stay relevant in the global travel industry while ensuring the needs of its residents are not overshadowed.

Airbnb Vs Traditional Rentals: The Scale Tips

Higher Profit Margins

When comparing Tel Aviv’s traditional rental market with Airbnb listings, there’s a clear winner in terms of profit. Short-term Airbnb rentals, owing to demand elasticity, often fetch higher daily rates than long-term traditional rentals.

Flexibility in Hosting

With Airbnb, property owners have the freedom to choose when and for how long they wish to rent out their space. Planning a summer staycation? Block out those dates. It’s as simple as pie!

Tel Aviv’s Unique Selling Points (USPs)

Tech Hub: Attracting Global Audience

As the Silicon Valley of the Middle East, Tel Aviv attracts a massive tech crowd. These tech-savvy travelers, often looking for comfortable and personalized stays, lean towards Airbnb over traditional hotel settings.

Melting Pot of Cultures

Tel Aviv’s diverse population, from its native Sabras to its influx of expatriates, adds to its charm. This multicultural fabric ensures varied demands in terms of Airbnb accommodations, from luxury sea-view apartments to quaint homes in historic neighborhoods.

Potential Challenges and Overcoming Them

The Competitive Market

No doubt, the Tel Aviv Airbnb market is competitive. But with the right property, pricing strategy, and a touch of local flavor, standing out from the crowd is achievable.

Legal Considerations

It’s imperative to keep abreast of local regulations and zoning laws pertaining to short-term rentals. Having a legal expert or consultant can prove invaluable in navigating this territory.

Conclusion: Embracing the Future of Real Estate Investments in Tel Aviv

Tel Aviv’s vibrant blend of historical charm, modern allure, and technological prominence positions it as an enticing hub for real estate investments, especially in the Airbnb sector. The city’s year-round tourism appeal, bolstered by its Mediterranean magnetism and tech-savvy visitors, offers investors a lucrative avenue for consistent returns. Moreover, the strong metrics from the Airbnb market underline the potential for growth and profitability, outpacing traditional rental avenues. While challenges exist, especially in terms of competition and regulatory considerations, the potential rewards make Tel Aviv’s Airbnb market a game-changer for discerning investors. As the global landscape of travel and accommodation evolves, investing in this Mediterranean gem’s Airbnb sector is not just a trend but a forward-thinking move into the future of real estate.

Explore: