There are many regions of Canada that are suitable for creating a thriving Airbnb business, and Victoria is one of the cities, where the industry is developing rapidly. Today, we will overview both the market conditions and the legislation surrounding the short-term vacation rental business there.

Advantages of Choosing Victoria for an Airbnb Business

The main advantage Victoria grants to local hosts is stability. The daily rates here are quite moderate, averaging around $200 throughout the year, while the average annual occupancy rate in the city is 88%. It allows local hosts to receive $3,784 worth of monthly revenue.

The competition in Victoria is rather intense, especially in the city center. However, as you can see from the occupancy rate, the supply is still covered by the demand. Moreover, there are still a lot of places outside the city center, which are not as densely populated with short-term rentals.

Airbnb Legislation in Victoria

The general legislation aimed at short-term vacation rentals in Victoria is almost the same as in most other regions of Canada. The entrepreneur will have to obtain a business license in order to operate. To do so, it will be necessary to comply with the eligibility requirements and apply for the license.

The eligibility requirements allow for two types of short-term rental properties. Firstly, a person is eligible to rent out their property, in case it is their principal residence. Such operations are allowed for renting out entire homes on occasion and for sharing up to two bedrooms in the principal residence.

Secondly, there is an option to rent out a legally non-conforming unit, in which such operations are permitted by the authorities. The full information regarding the eligibility of such units is available on the official website of the city of Victoria.

Getting a License to Operate in Victoria

The application process for a short-term rental business license in Victoria is rather straightforward. To obtain a permit, the entrepreneur has to submit a filled-out application form to the local authorities. To fill out the form, it will be necessary to state the type of your property, the IDs of the listings, in case it is already advertised online, its address, mailing, ownership, and other details.

The fee for the business license depends on the type of property. For principal residences, it is $150, while for other types of short-term rentals, it is $1,500. The fee for the license is paid annually.

Short-Term Rental Business Taxes in Victoria

There are two taxes applied to short-term rentals in Victoria: Provincial Sales Tax (PST) and Municipal and Regional District Tax (MRDT). The rates for them may vary, but they are capped at 8% and 3% respectively.

It is necessary for the host to charge the guests with these taxes and file all the corresponding tax returns annually. There are some exceptions that allow entrepreneurs not to collect these taxes, but most of them are not applicable to Airbnb. To learn all the details about taxation, feel free to visit the official websites of Victoria and British Columbia.

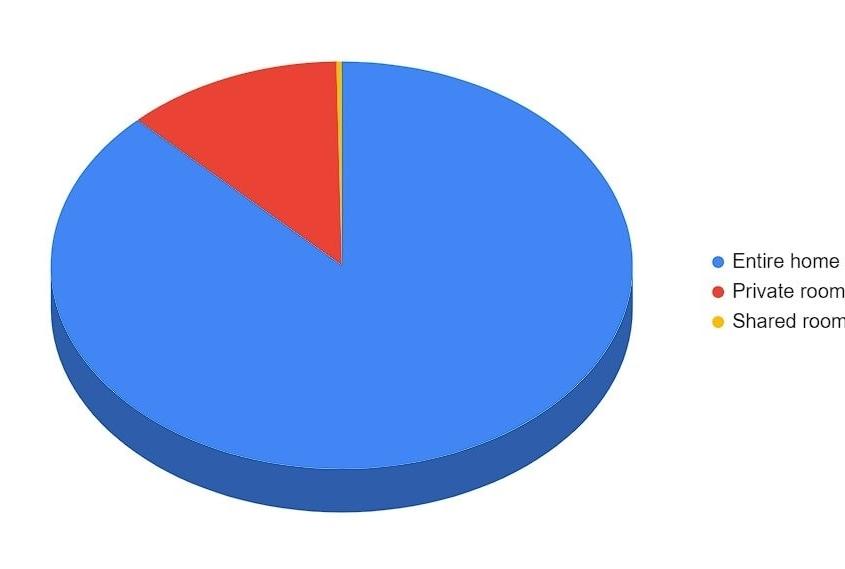

Airbnb hosts can rent out entire properties, private or shared rooms.

- 1 097 – listings in total

- 964 (87%) – entire properties

- 130 (12%) – private rooms

- 3 (0.3%) – shared rooms.

964 (87%) – entire home

130 (12%) – private rooms

3 (0.3%) – shared rooms

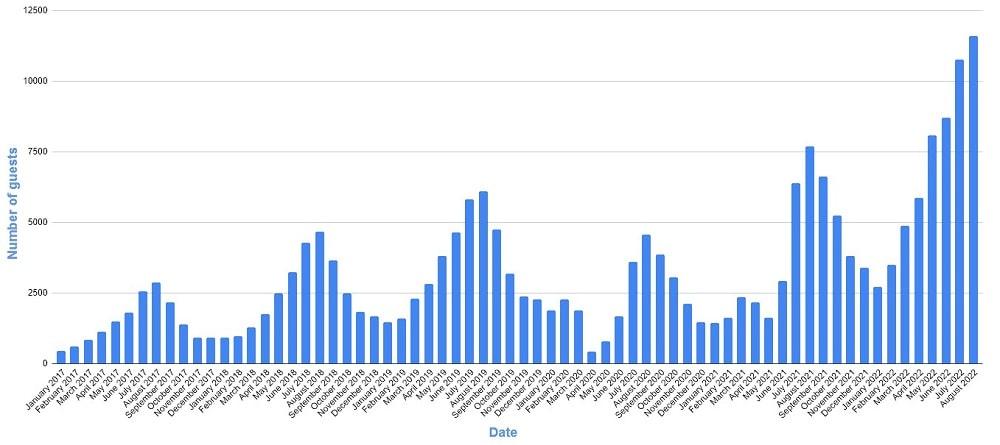

Airbnb guests may leave a review after their stay, and these can be used to estimate Airbnb guests activity. However not all guests leave a review, so the actual activity could be higher.

- $160 – average daily rate

- 88% – occupancy rate

- $2 975 – revenue.

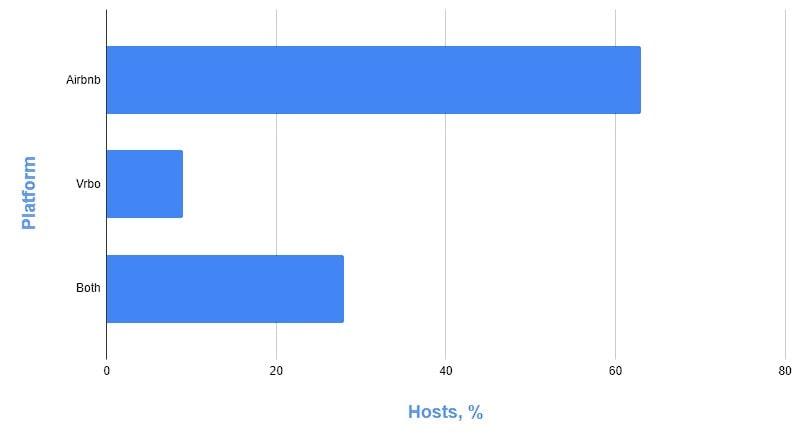

When you assess the Airbnb market in Montreal, you’ll notice that there are some hosts who have multiple listings and some that have single listings, just like everywhere else in the world. Also, owners can list their property on 1 or more platforms.

- 63% – listed on Airbnb

- 9% – listed on Vrbo

- 28% – listed on both.

Airbnb hosts have full freedom when it comes to selecting how available their property or rooms are. For instance, by utilizing the calendar tool, a host can set their property to be available for just one week in a year. Alternatively, another example is a host setting their rooms to be available for 11-months out of the 12.

- Available

- 1-90

- 91-180

- 181-270

- 271-365

- Properties

- 656

- 290

- 274

- 286

- %

- 44

- 19

- 18

- 19

Sources