Sydney has specific regulations in place for short-term rentals, including those listed on Airbnb. These regulations were enacted by the New South Wales (NSW) government to address concerns related to the impact of short-term rentals on housing availability and neighborhood amenity.

In Sydney, hosts are required to obtain a short-term rental accommodation permit from the local council. The permit ensures that the property meets certain safety and amenity standards. Hosts must also comply with the specific zoning and planning regulations of their respective local government area.

The regulations in Sydney include restrictions on the number of nights a property can be rented out as a short-term rental. Hosts can only rent out their entire home or apartment for a maximum of 180 nights per calendar year, regardless of whether the host is present during the guest’s stay. This limitation is in place to preserve housing availability and prevent properties from being solely used as dedicated short-term rentals.

Hosts are also required to maintain appropriate insurance coverage for their short-term rental property. This may include public liability insurance and coverage for potential damages or incidents that may occur during guests’ stays.

Short-term rental platforms like Airbnb are required to enforce compliance with these regulations. They are responsible for ensuring that hosts have the necessary permits and licenses to operate, and they are required to regularly report data to the NSW government.

It is important for hosts to be aware of their responsibilities and obligations under the regulations, as non-compliance may result in penalties and fines. Hosts should familiarize themselves with the specific requirements of their local council and ensure that their listings and operations adhere to all applicable rules.

Given the dynamic nature of regulations, it is advisable to consult with local authorities or legal professionals to obtain the most accurate and up-to-date information regarding short-term rental regulations in Sydney, Australia.

Complete guide to the Sydney Tax Regulations on Airbnb earnings read here.

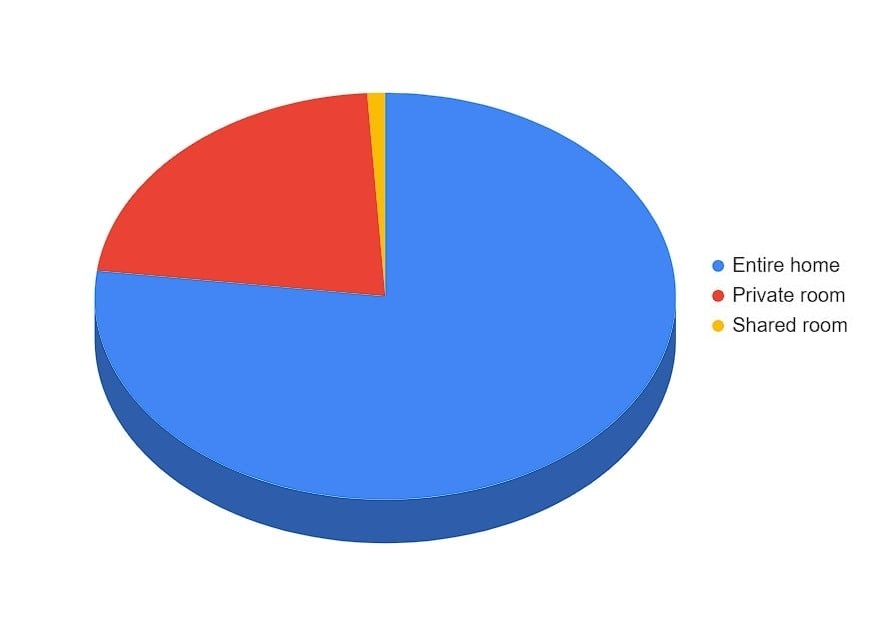

The opportunities are endless for hosts who wish to generate extra income through the Airbnb platform. Whether you have an entire property available, or just wish to rent out some private or shared rooms, then you can tap into the huge Airbnb market.

- 12 169 – listings in total

- 9 361 (77%) – entire properties

- 2 703 (22%) – private rooms

- 105 (1%) – shared rooms

2 703 (22%) – private rooms

105 (1%) – shared rooms

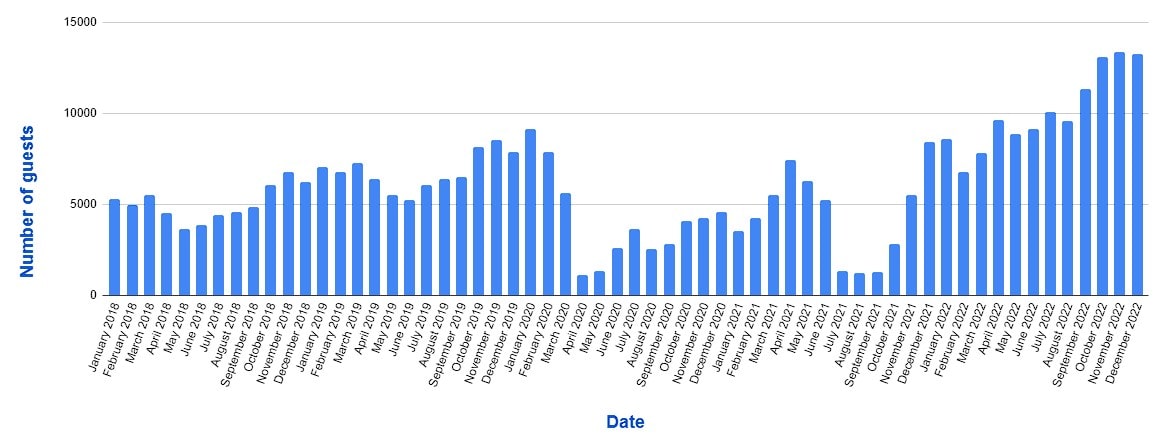

Airbnb guests may leave a review after their stay, and these can be used to estimate Airbnb guests activity. However not all guests leave a review, so the actual activity could be higher.

- $195 – average daily rate

- 78% – occupancy rate

- $2 658 – revenue.

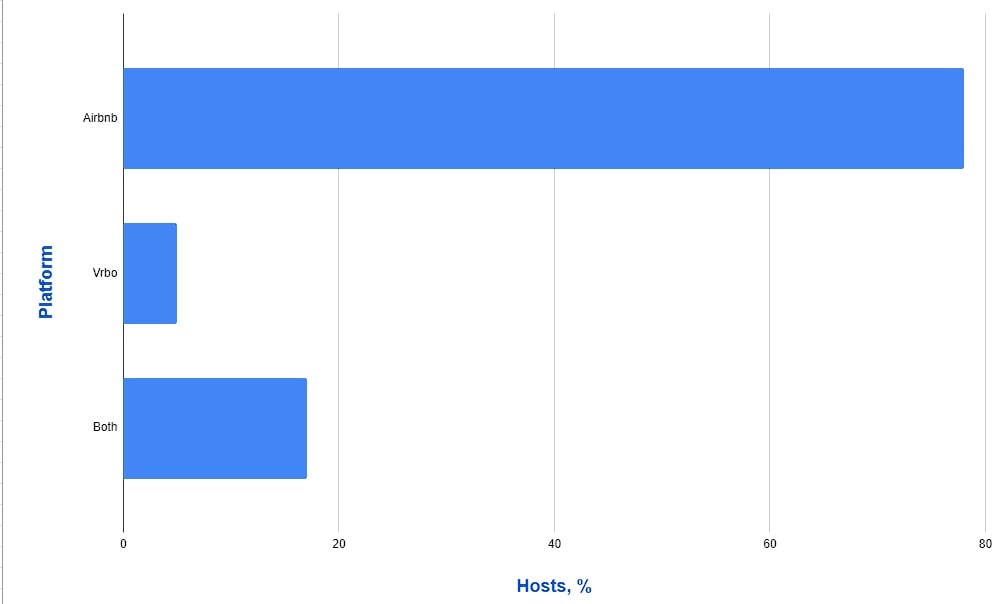

When you assess the Airbnb market in Montreal, you’ll notice that there are some hosts who have multiple listings and some that have single listings, just like everywhere else in the world. Also, owners can list their property on 1 or more platforms.

- 78% – listed on Airbnb

- 5% – listed on Vrbo

- 17% – listed on both.

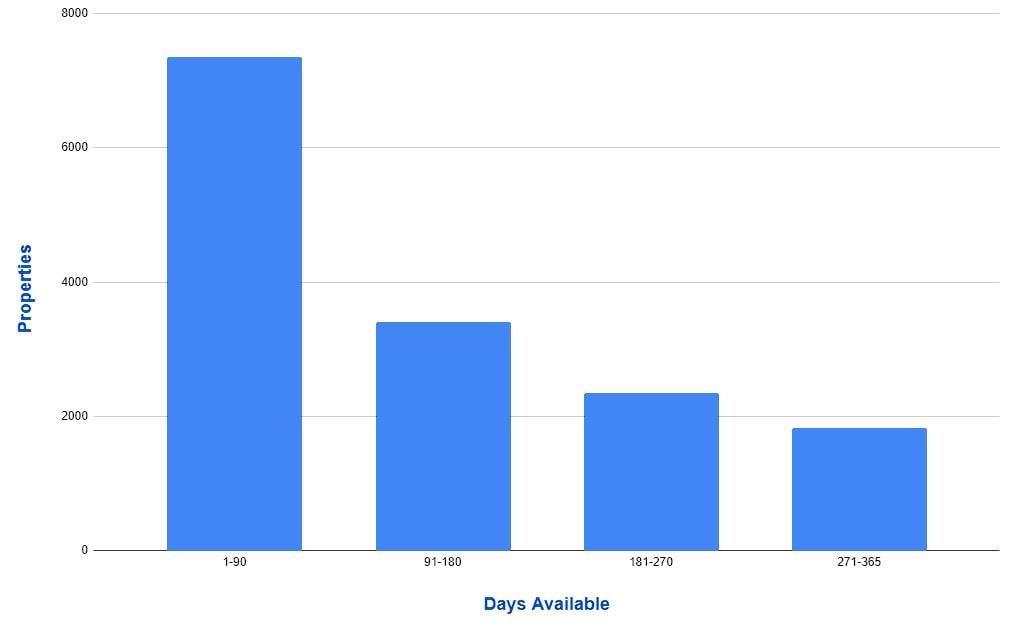

Airbnb hosts have full freedom when it comes to selecting how available their property or rooms are. For instance, by utilizing the calendar tool, a host can set their property to be available for just one week in a year. Alternatively, another example is a host setting their rooms to be available for 11 months out of the 12.

- Available

- 1-90

- 91-180

- 181-270

- 271-365

- Properties

- 7351

- 3410

- 2342

- 1825