Seattle, Washington, has implemented specific regulations for short-term rentals, including those listed on Airbnb. These regulations were enacted to address concerns related to housing affordability and to maintain a balance between the needs of residents and the growing popularity of short-term rentals.

Hosts in Seattle are required to obtain a short-term rental license from the city. To qualify for a license, hosts must meet certain criteria, such as providing proof of ownership or legal permission to rent the property, and ensuring the property meets safety requirements. Additionally, hosts are limited to a maximum of two dwelling units per individual or entity.

A key aspect of Seattle’s regulations is the distinction between different types of short-term rentals. If the host is not present on the property during the guest’s stay, the rental is categorized as a “whole-unit rental.” Hosts can only operate a whole-unit rental for a maximum of 90 nights per calendar year unless they meet certain criteria for additional nights. If the host is present on the property, there is no limit on the number of nights they can rent out.

Short-term rental platforms like Airbnb are required to obtain a regulatory license from the city and are responsible for reporting data about hosts and bookings to the city government. This allows for better monitoring and enforcement of the regulations.

Hosts in Seattle must also collect and remit taxes on their short-term rental bookings. This includes the city’s 9.6% tax on short-term rentals, as well as the state and county taxes. Airbnb automatically collects and remits these taxes on behalf of hosts, simplifying the process.

It is important for hosts to be aware of their responsibilities, including maintaining appropriate insurance coverage and adhering to safety requirements, such as providing functioning smoke detectors and fire extinguishers.

By implementing these regulations, Seattle aims to strike a balance between allowing short-term rentals and addressing housing affordability concerns. Hosts and guests should familiarize themselves with these regulations and fulfill their obligations to ensure compliance and a positive short-term rental experience in Seattle.

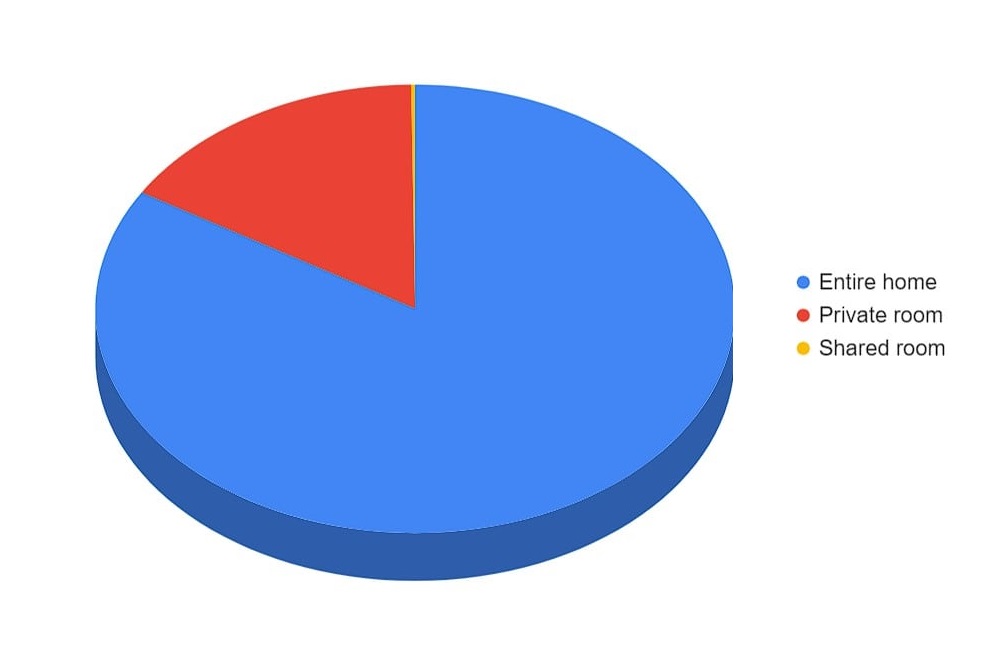

The opportunities are endless for hosts who wish to generate extra income through the Airbnb platform. Whether you have an entire property available, or just wish to rent out some private or shared rooms, then you can tap into the huge Airbnb market.

- 6 303 – listings in total

- 5 251 (83%) – percentage of the total which are entire properties

- $162 – average price per night

- 1 038 (16%) – private rooms

- 14 (0.2%) – shared rooms

5 251 (83%) – entire properties

1 038 (16%) – private rooms

14 (0.2%) – shared rooms

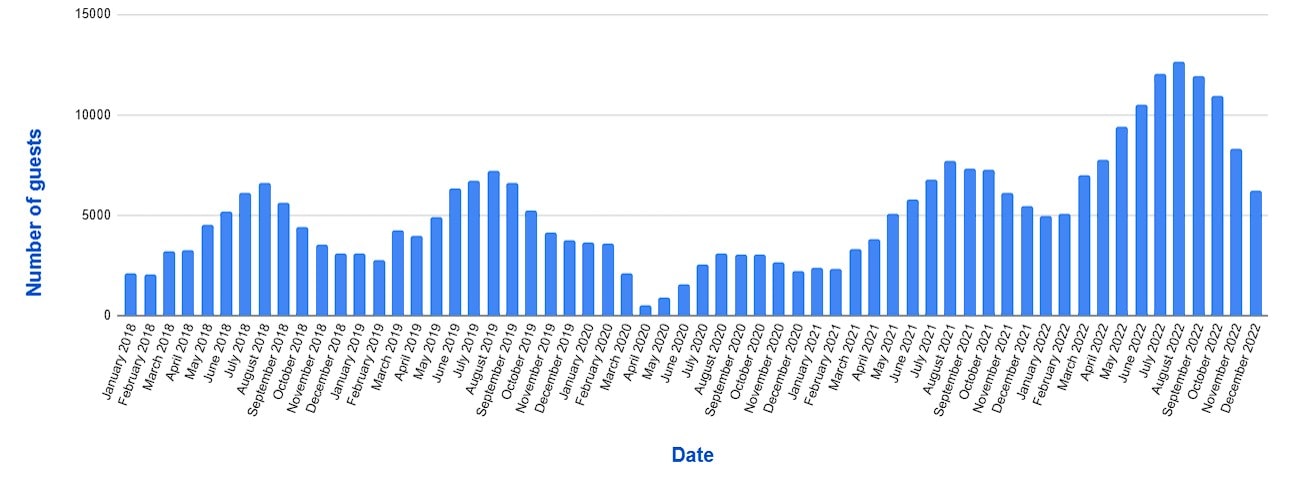

In order for the guest activity to be recorded and monitored, a review must be submitted to a host’s property or room after the stay has been completed. In terms of the statistics that have been produced – they have been calculated by using the minimum stay, the average price per night, and the total number of reviews.

- $187 – average daily rate

- 77% – occupancy rate

- $2 896 – revenue.

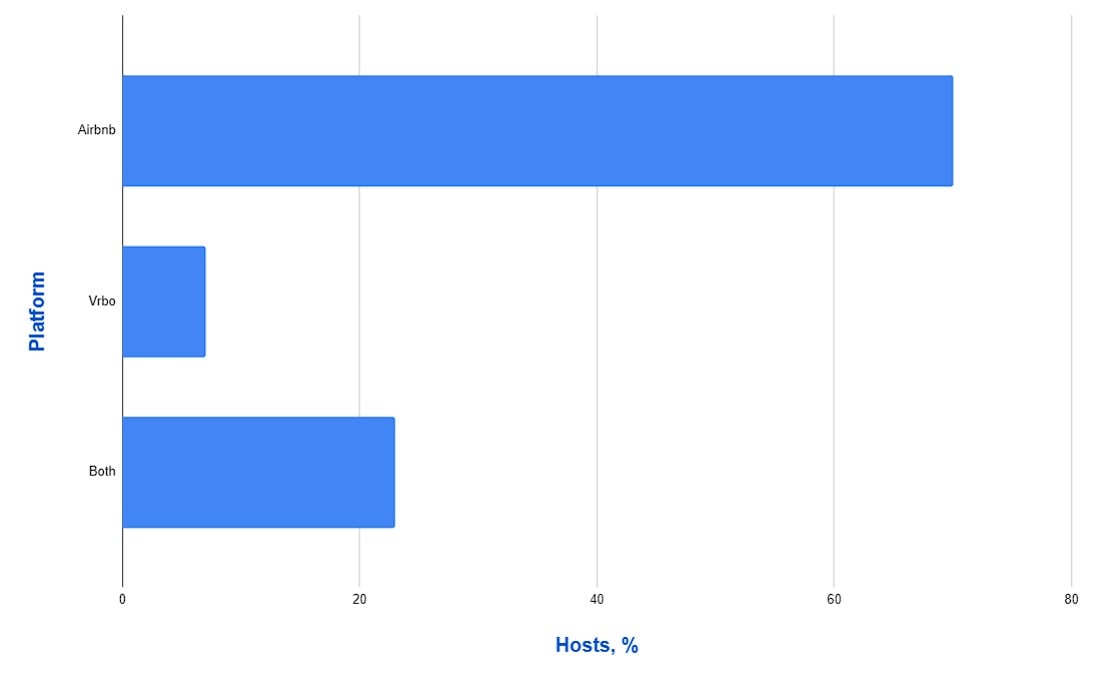

When you assess the Airbnb market in Seattle, you’ll notice that there are some hosts who have multiple listings and some that have single listings, just like everywhere else in the world. It is possible for a host to list multiple properties that they have available or different rooms which are available on the same property.

- 70% – listed on Airbnb

- 7% – listed on Vrbo

- 23% – listed on both.

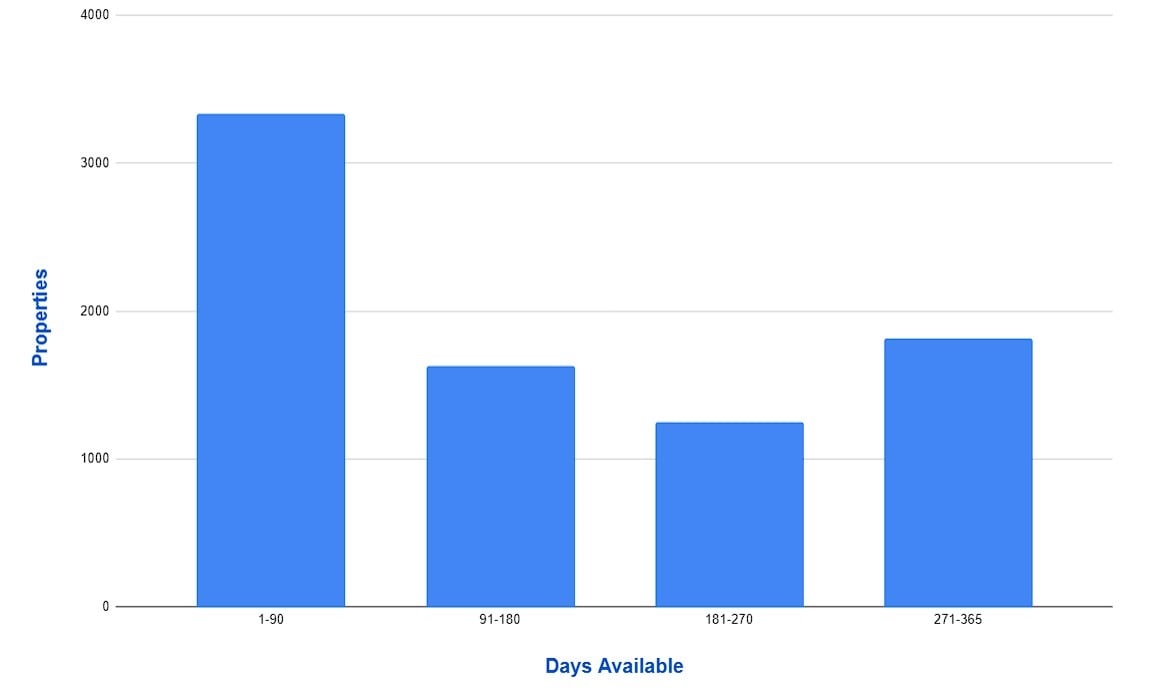

Airbnb hosts have full freedom when it comes to selecting how available their property or rooms are. For instance, by utilizing the calendar tool, a host can set their property to be available for just one week in a year. Alternatively, another example is a host setting their rooms to be available for 11-months out of the 12.

- Available

- 1-90

- 91-180

- 181-270

- 271-365

- Properties

- 3331

- 1626

- 1251

- 1811

- %

- 42

- 20

- 16

- 23

You can find information about legal demands for short rentals in Seattle by the links below.

Sources