Montreal is a lovely and well-developed city in the Canadian province of Quebec. Tourists from all over the world flock to this area to take in the gorgeous natural beauties, raid trading centers, or have a better grasp of the city’s rich culture and history.

The idea of starting a short-term rental business in Montreal appeals to many individuals with business acumen. If your entrepreneurial spirit pushes you to become a host, here is some useful information about Airbnb laws and regulations in Montreal you should familiarize yourself with before getting up to your neck in the venture.

Montreal Airbnb Laws and Regulation

The key to the success of any undertaking is a clear understanding of local laws, regulations, and restrictions. As for the short-term Airbnb business in Montreal, you should first scrutinize the website or visit the department of CITQ (Corporation de l’Industrie Touristique du Quebec), an authority that handles tourist accommodation registrations in Quebec. Consulting with a local lawyer and a tax professional is also highly advisable before you break new ground.

In Quebec, tourist lodging laws are different between those who provide tourist lodging in their primary residence and those who provide tourist accommodation outside their primary residence.

Registration

The Province laws mandate that any person, who is offering tourist lodging in their primary and/or secondary residence for rent for 31 days or less and charging money for such services, must obtain a certificate of classification through CITQ. Detailed information on how to register an application for this certificate can be found on the Tourisme Quebec website. This also applies to hosts offering their services in the Montreal area.

Some requirements are imposed on the procedure of obtaining a classification certificate for the Airbnb business. For instance, the host must comply with the established municipal laws, hold a $2 million general liability insurance policy, advertise their short-term rental home on public channels (such as Airbnb), and pass a procedure of the unit assessment performed by the CITQ agent.

This CITQ agent will look at the quality of your rental property and the services offered, evaluate the level of its maintenance and sanitation state, and determine its level of sustainability (availability of public transportation, proximity to stores and main city infrastructure etc.)

The tourist law in Montreal also obliges all short-term rental entrepreneurs to supply their listing with the registration number across all sales channels they advertise on. The host’s dashboard on Airbnb has a special functionality allowing you to easily add a registration number to your listing.

Business License

Certain commercial establishments in Montreal can only operate if they have a commercial permit or certificate. You should scrutinize these requirements to determine if they apply to your particular short-term rental business. More information about permits and certifications in each area can be found here.

Authorized Areas

Short-term rentals can be allowed to operate only in specific localities in Montreal. Generally, Airbnb rental business is not allowed to be arranged in the city’s most popular areas (downtown) as well as boroughs with great density.

In Montreal, each borough has its Master Plan that determines the city’s planning and development vector, including land uses and building density requirements. This Master Plan also decides whether the particular area can contain short-term rentals, and which requirements apply to them. To find out whether your property is placed in the authorized zone, you should consult the permits counter. If you qualify, a business activity permit will be issued.

Taxation

Under the Quebec Sales Tax Law, a property tax is levied every time a property is rented out for more than six hours and up to 31 consecutive days in most tourist areas in Quebec, including Montreal. Quebec and its municipalities levy various other taxes that may be levied on residents who generate income from renting out vacation properties to tourists. Fortunately, Airbnb automatically collects this tax from Montreal hosts and remits it to Revenu Quebec.

Other Considerations

Most of the rules regarding short-term Airbnb rentals are still being revised in Montreal, so it is wise that you call your municipality and inquire about the possibility of opening a short-term rental business in your particular area.

Different boroughs in Montreal may establish their specific requirements regarding short-stay rental organizations. For instance, in southwestern areas of Montreal, a classification certificate can only be given if your vacation rental property falls under the category of either a BnB (bed-and-breakfast) or an apartment hotel.

Also, bear in mind that Montreal restricts the use of key boxes in rental properties. If city officials see that you have such a lockbox near your Airbnb property, such a device will be removed.

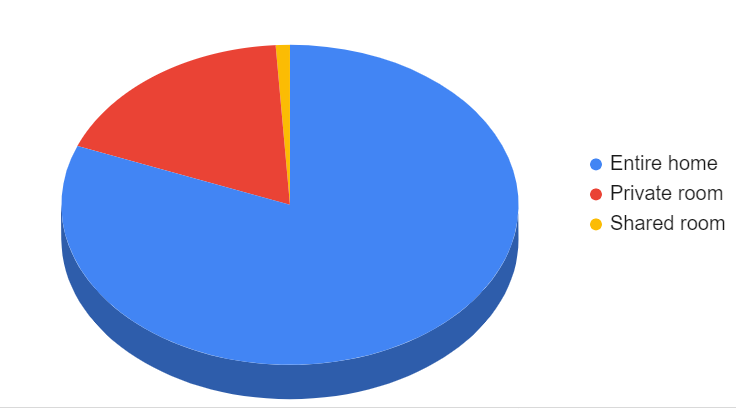

Airbnb hosts can rent out entire properties, private or shared rooms.

- 6578 – listings in total

- 5336 (81%) – entire properties

- 1190 (18%) – private rooms

- 52 (1%) – shared rooms.

1190 (18%) – private rooms

52 (1%) – shared rooms

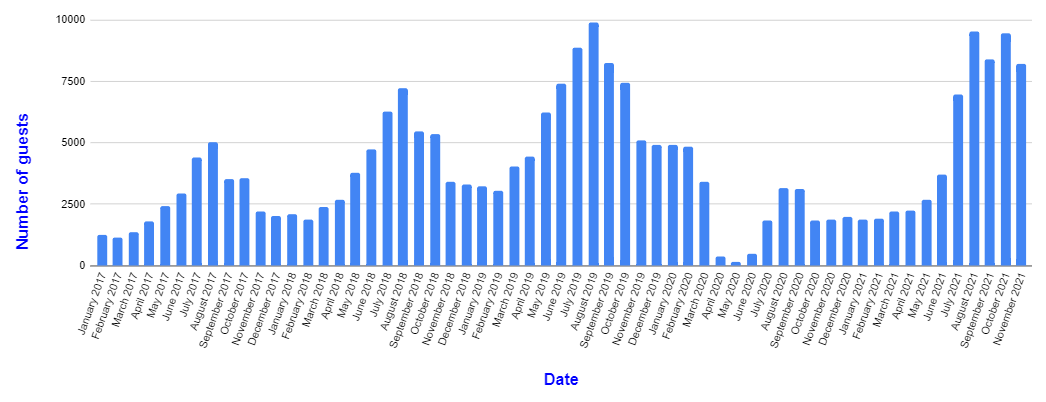

Airbnb guests may leave a review after their stay, and these can be used to estimate Airbnb guests activity. However not all guests leave a review, so the actual activity could be higher.

- $127 – average daily rate

- 63% – occupancy rate

- $1 365 – revenue.

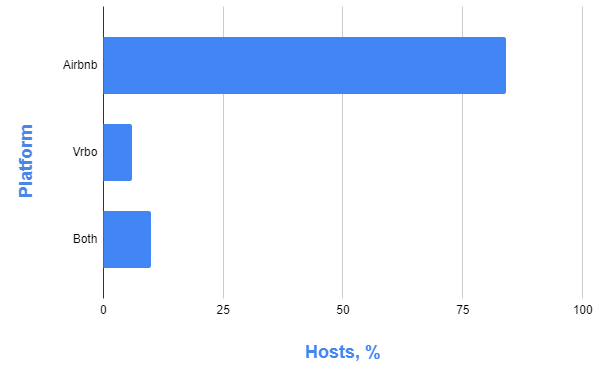

When you assess the Airbnb market in Montreal, you’ll notice that there are some hosts who have multiple listings and some that have single listings, just like everywhere else in the world. Also, owners can list their property on 1 or more platforms.

- 84% – listed on Airbnb

- 6% – listed on Vrbo

- 10% – listed on both.

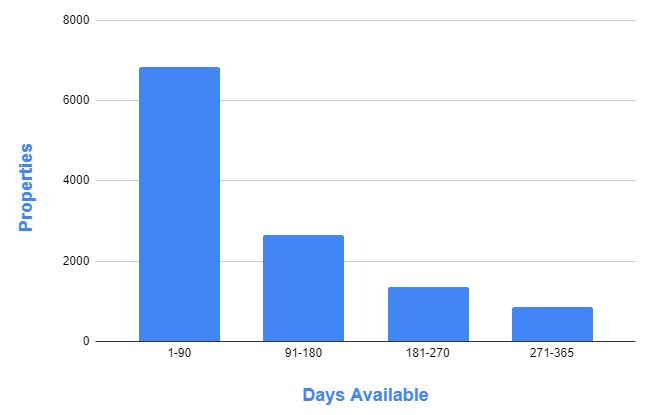

Airbnb hosts have full freedom when it comes to selecting how available their property or rooms are. For instance, by utilizing the calendar tool, a host can set their property to be available for just one week in a year. Alternatively, another example is a host setting their rooms to be available for 11-months out of the 12.

- Available

- 1-90

- 91-180

- 181-270

- 271-365

- Properties

- 6847

- 2656

- 1358

- 844

- %

- 58

- 23

- 12

- 7