Copenhagen, Denmark, has implemented specific regulations for short-term rentals, including those listed on Airbnb. These regulations were put in place to manage the impact of short-term rentals on the housing market and to balance the interests of residents and tourists.

In Copenhagen, hosts are required to obtain a permit to legally rent out their property as a short-term rental. This permit is granted by the local municipality and is subject to certain criteria. Hosts must be able to prove that they reside in the property for at least 180 days per year and that the property is their primary residence. Additionally, hosts are only allowed to rent out their entire home for a maximum of 90 days per calendar year when they are not present. There are no limitations on the number of days they can rent out their home if they are present during the guest’s stay.

Moreover, hosts must comply with specific regulations regarding noise levels and the number of guests allowed on the property at any given time. These regulations aim to ensure that short-term rentals do not disrupt the peace and well-being of residential neighborhoods.

Copenhagen also enforces strict tax regulations for short-term rentals. Hosts are required to collect and remit a tourist tax, known as the “overnatningsskat” or overnight tax. Airbnb automatically collects and remits this tax on behalf of hosts, simplifying the process.

Enforcement of these regulations is taken seriously in Copenhagen, and authorities actively monitor short-term rental platforms to ensure compliance. Non-compliance with the regulations may result in penalties and fines.

It’s important for hosts to be aware of their responsibilities under the regulations and to ensure that their short-term rental activities are fully compliant. By doing so, hosts can contribute to a responsible and sustainable short-term rental market in Copenhagen while respecting the needs and interests of the local community. However, given the dynamic nature of regulations, hosts should verify the most up-to-date information from the relevant authorities or consult legal professionals to ensure compliance with current rules and requirements.

A Local guide to Copenhagen for your Airbnb guests read here.

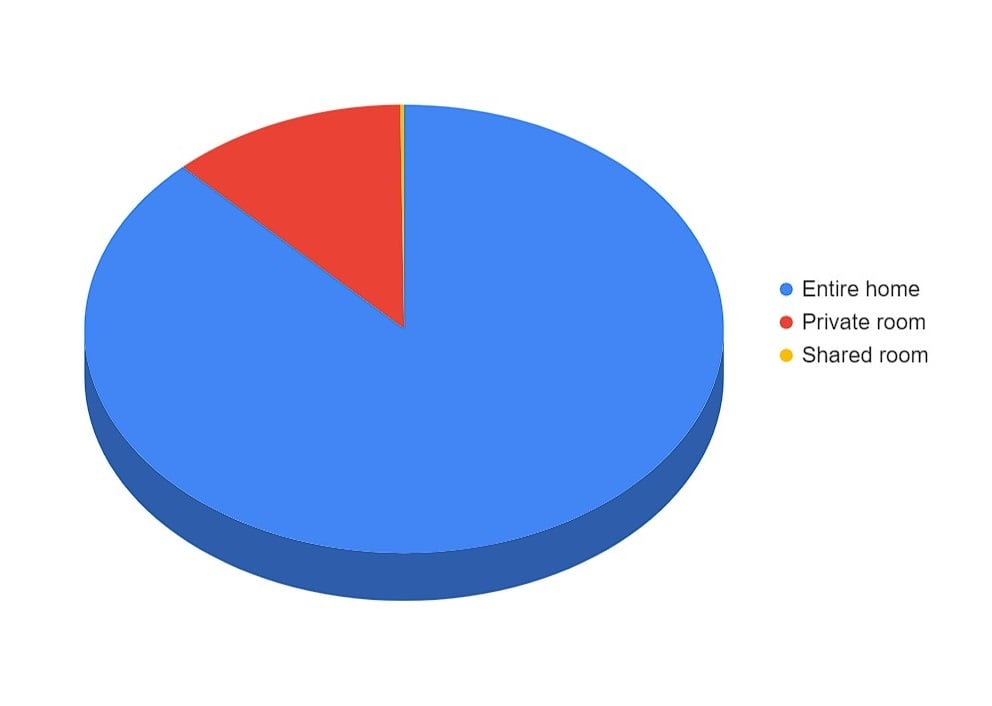

Airbnb hosts can rent out entire properties, private or shared rooms.

- 9 284 – listings in total

- 8 155 (88%) – entire properties

- 1 109 (12%) – private rooms

- 20 (0.2%) – shared rooms.

8 155 (88%) – entire properties

1 109 (12%) – private rooms

20 (0.2%) – shared rooms

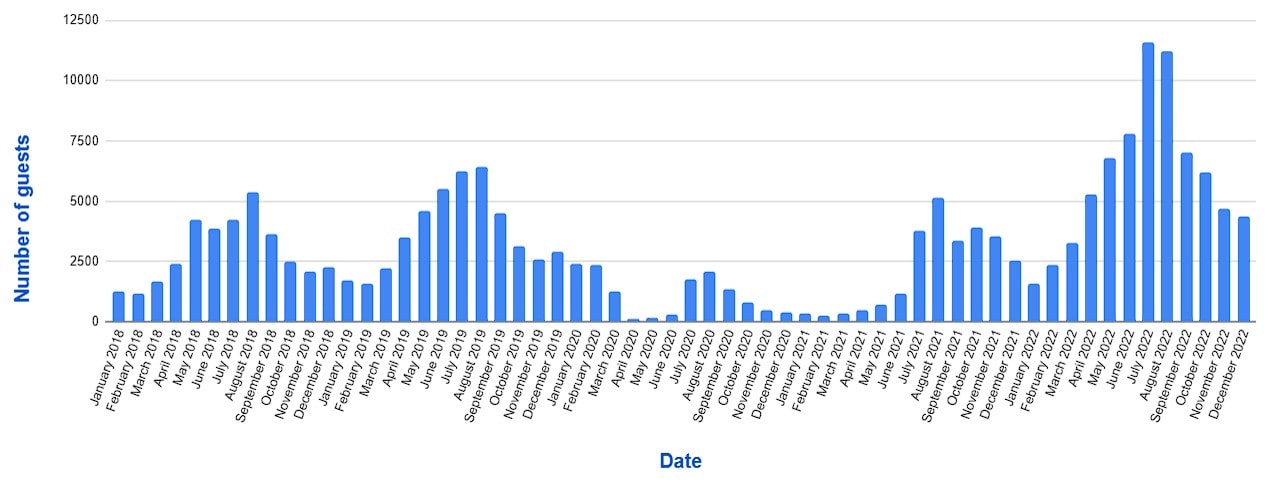

Airbnb guests may leave a review after their stay, and these can be used to estimate Airbnb guests activity. However not all guests leave a review, so the actual activity could be higher.

- $167 – average daily rate

- 82% – occupancy rate

- $1 846 – revenue.

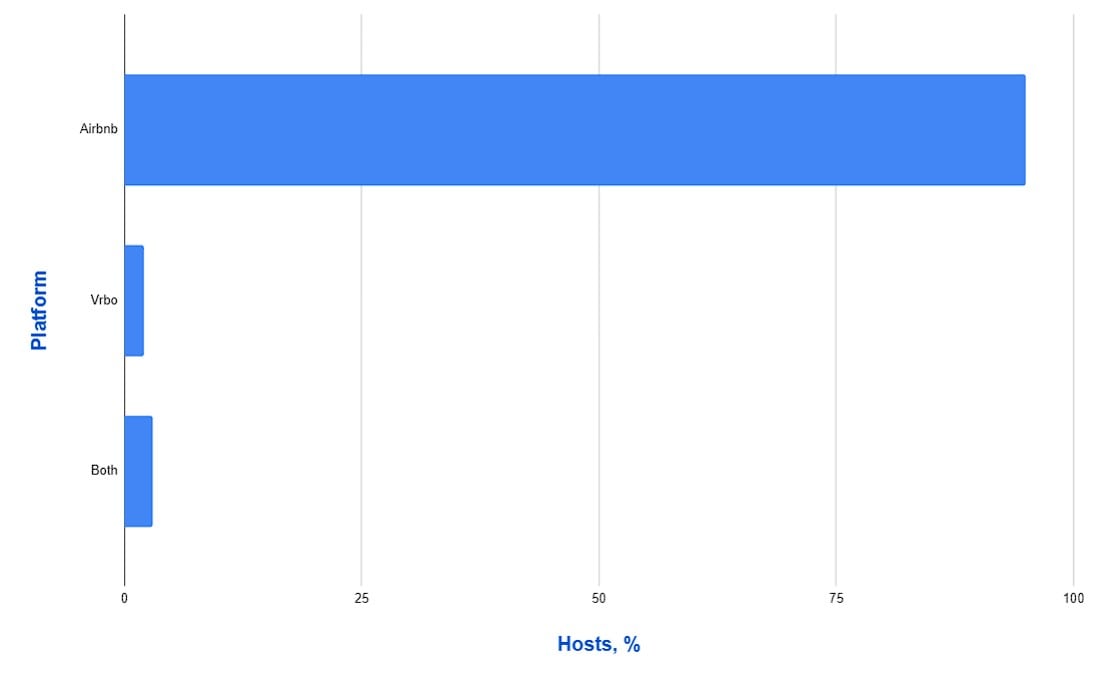

When you assess the Airbnb market in Montreal, you’ll notice that there are some hosts who have multiple listings and some that have single listings, just like everywhere else in the world. Also, owners can list their property on 1 or more platforms.

- 95% – listed on Airbnb

- 2% – listed on Vrbo

- 3% – listed on both.

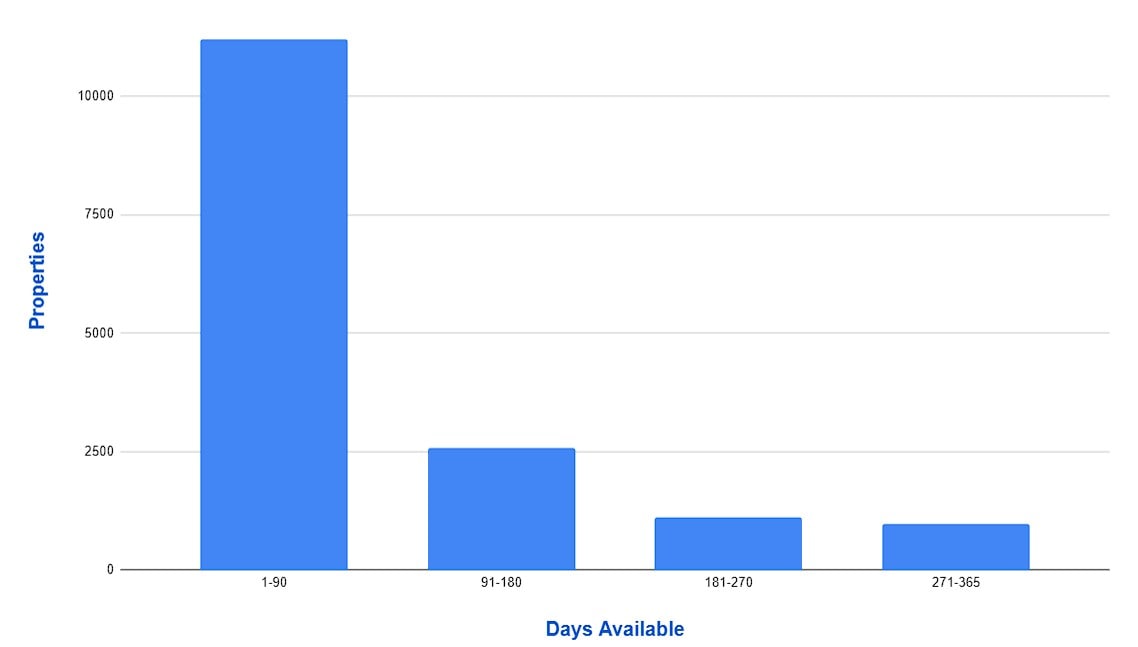

Airbnb hosts have full freedom when it comes to selecting how available their property or rooms are. For instance, by utilizing the calendar tool, a host can set their property to be available for just one week in a year. Alternatively, another example is a host setting their rooms to be available for 11-months out of the 12.

- Available

- 1-90

- 91-180

- 181-270

- 271-365

- Properties

- 11201

- 2589

- 1102

- 979

- %

- 71

- 16

- 7

- 6